Online Payment

Switch to a more efficient online payment system

Optimize your payments experience. Accept 30+ digital payment methods with ease and enjoy high success rates for every transaction.

Trusted by:

Accepting online payments has never been this easy

Build a simple and complete online payment system with Bayarind.

Various integrations

Reach even more customers! Choose Bayarind as a payment solution that connects seamlessly to any platform you use.

Your Business, your rates

Our rates are flexible and can be adjusted to suit your business, taking into account your payment volume and average transaction size.

Real-time transaction reports

Access real-time transaction data from all payment methods in a single location – say goodbye to complicated reconciliation reporting!

More ways to pay, more sales every day

No more missed sales. Increase your conversions and customer satisfaction by offering multiple payment methods and letting customers choose their preferred options.

- Credit/debit card

- Virtual Account

- E-Wallet/Digital Wallet

- Bank transfer

- QR Code

- Mobile Banking

Smart, scalable solutions tailored for your business

Wherever your business is located, automate your business's online payments more efficiently with Bayarind

API

Connect our API to your website or app and develop a flexible, customer-centric payment system.

Plugin

Seamlessly integrate with your favorite e-commerce platforms: WooCommerce, Magento, Prestashop, WHMCS, and more.

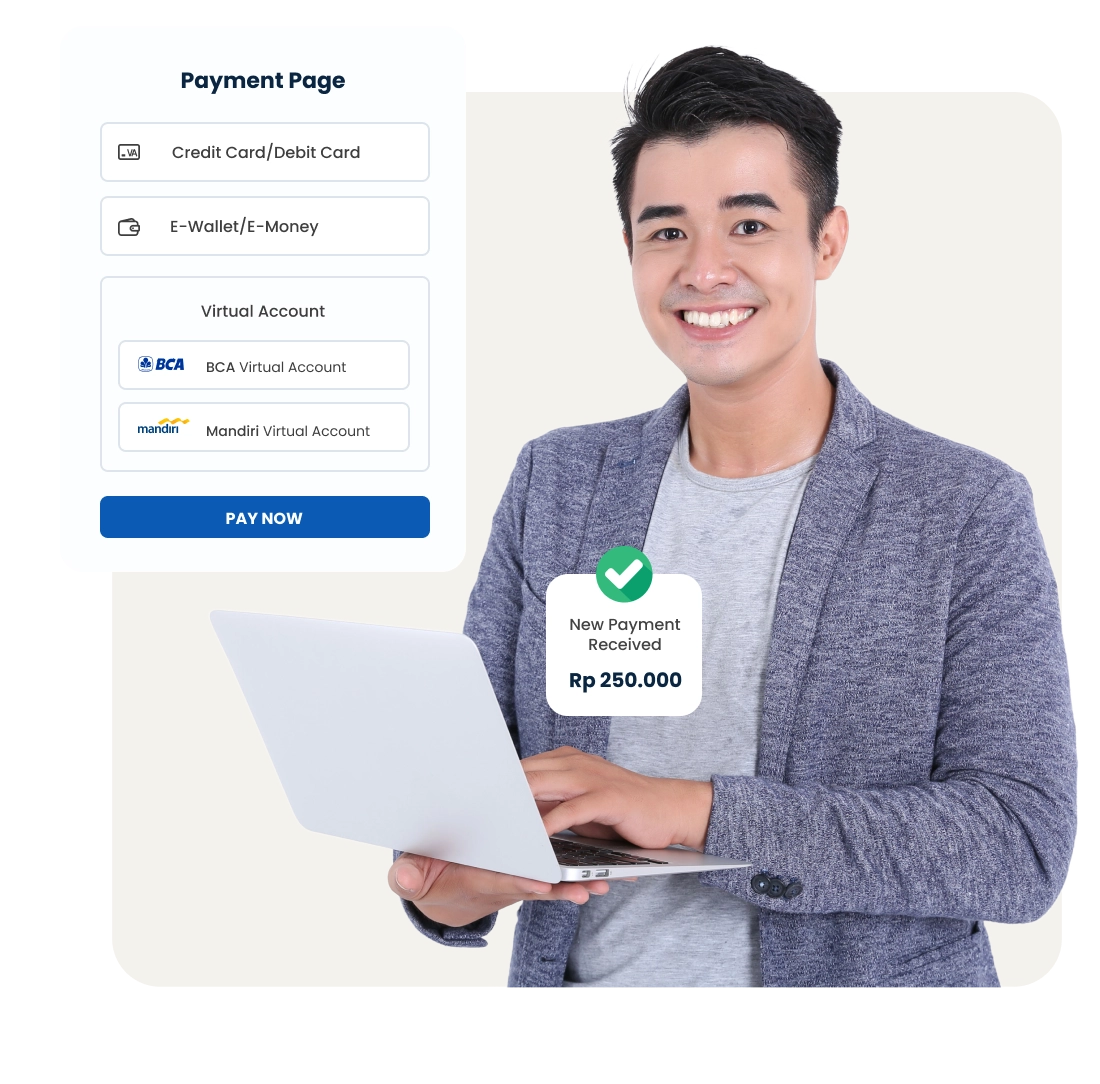

Payment Page

Make payments effortless for your customers with our Payment Page, designed for a simple checkout.

Payment Link

Generate payment links, send, and get paid instantly. No technical integration needed – fast and easy.

Have peace of mind during transactions

Encrypted connections, transaction processes, and customer data are secure with Bayarind. We adhere to annually updated international safety regulations and standards, including:

- ISO 27001

- PCI DSS

- Fraud Detection System

One dashboard to monitor all transactions

Monitor all your payment activity in one well-organized place. Make decisions faster and more precisely.

- Get real-time notifications when receiving payments

- Add multiple users with different access options to increase team efficiency

- Make the reconciliation process smoother and more automated

We have also been registered and have permits from Bank Indonesia and the Ministry of Communication and Information of the Republic of Indonesia (Kominfo).

Choose the right package for your business

Growing Business

Innovative and up-to-date transaction solutions to increase public awareness and understanding without using cash with the freedom to move independently and safely.

View PriceEnterprise Business

We support economic growth by encouraging business people to make transactions through an online payment system which automatically opens up new, wider market opportunities.

Contact usProducts and related information

Disbursement

Send funds to many destinations to speed up the refund process to customers without having to collect customer accounts.

Pricing

Initial registration is free, and is only charged when the transaction is successful.

FAQ

Apa itu sistem pembayaran online?

Sistem pembayaran online adalah salah satu metode pembayaran yang dilakukan melalui koneksi internet tanpa melibatkan alat elektronik tertentu.

Cara ini biasanya menggunakan fasilitas dari penyedia layanan keuangan seperti bank dan dompet digital serta situs e-commerce atau toko online sebagai media pembayaran. Dibandingkan dengan metode tunai, transaksi digital lebih cepat, mudah, dan aman.

Dengan perkembangan teknologi di era digital, online payment akan memenuhi kebutuhan pelanggan untuk melakukan transaksi pembayaran kapan saja dan di mana saja, tanpa perlu pergi ke toko fisik dan membawa uang tunai. Dengan mengadopsi layanan pembayaran seperti ini dapat meningkatkan efisiensi operasional bisnis online dengan mengotomatisasi proses pembayaran dan pencatatan transaksi.

Pilihan metode pembayaran yang disediakan oleh Bayarind meliputi e-wallet & e-money, kartu kredit & debit, virtual account, transfer bank, internet banking, dan QR code. Dengan beragam opsi ini, pelanggan dapat memilih jenis metode pembayaran yang paling nyaman bagi mereka saat melakukan transaksi online.

Untungnya payment gateway Bayarind memiliki beragam keunggulan yang membantu bisnis Anda berkembang semakin cepat, termasuk menawarkan metode pembayaran populer tanpa perlu membuat banyak rekening bank, fitur integrasi yang mudah dan canggih, serta sistem keamanan transaksi yang terjamin.

Sistem pembayaran online bekerja dengan memfasilitasi transaksi keuangan melalui internet. Pengguna biasanya memilih metode pembayaran yang diinginkan, memasukkan informasi pembayaran yang diperlukan, dan menyelesaikan transaksi tanpa perlu mengkonfirmasi pembayaran.

Di Bayarind, tidak ada biaya registrasi sedikit pun. Anda hanya dikenakan biaya saat transaksi pembayaran berhasil. Tidak ada biaya pemrosesan atau bahkan biaya pemeliharaan yang memberatkan bisnis Anda.